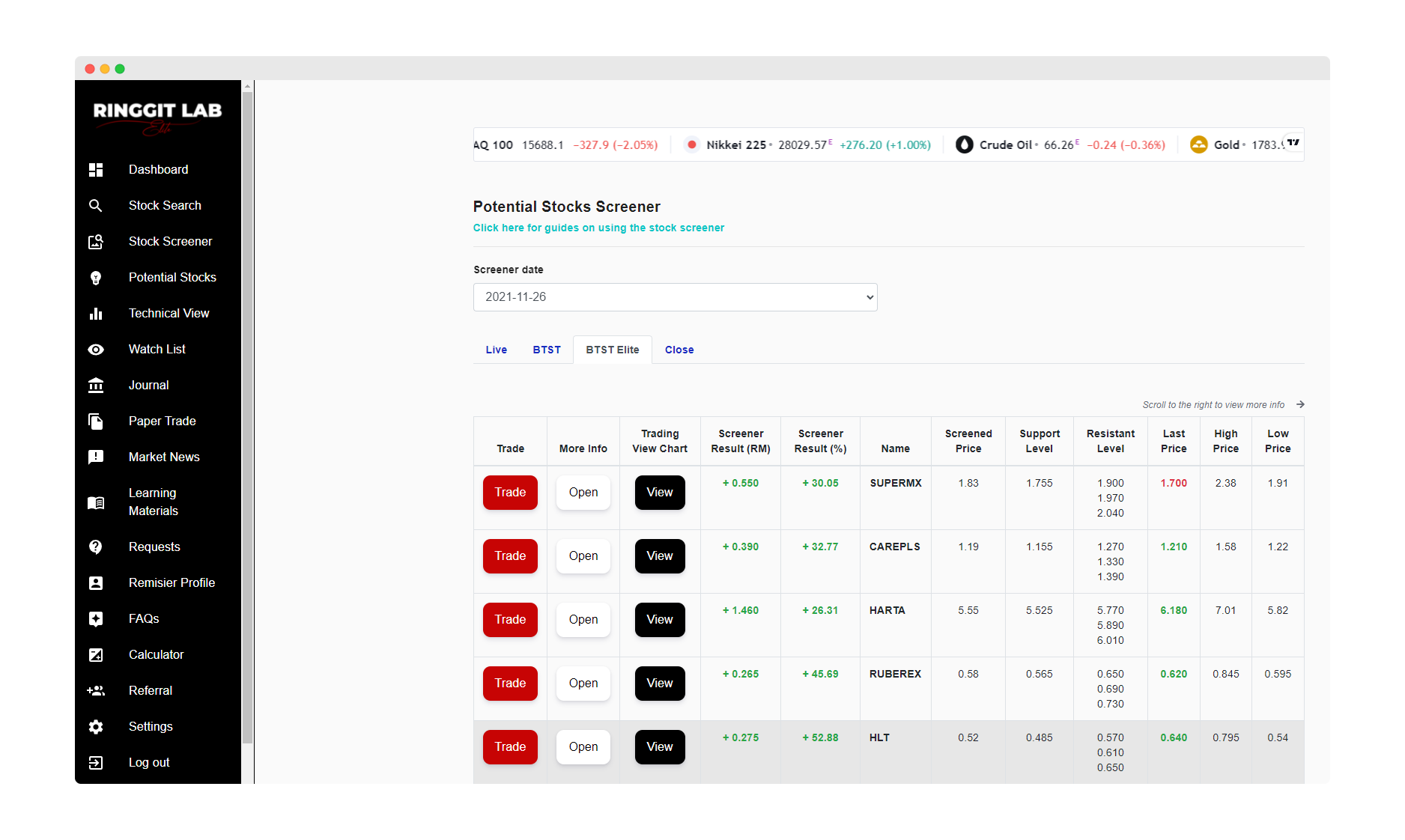

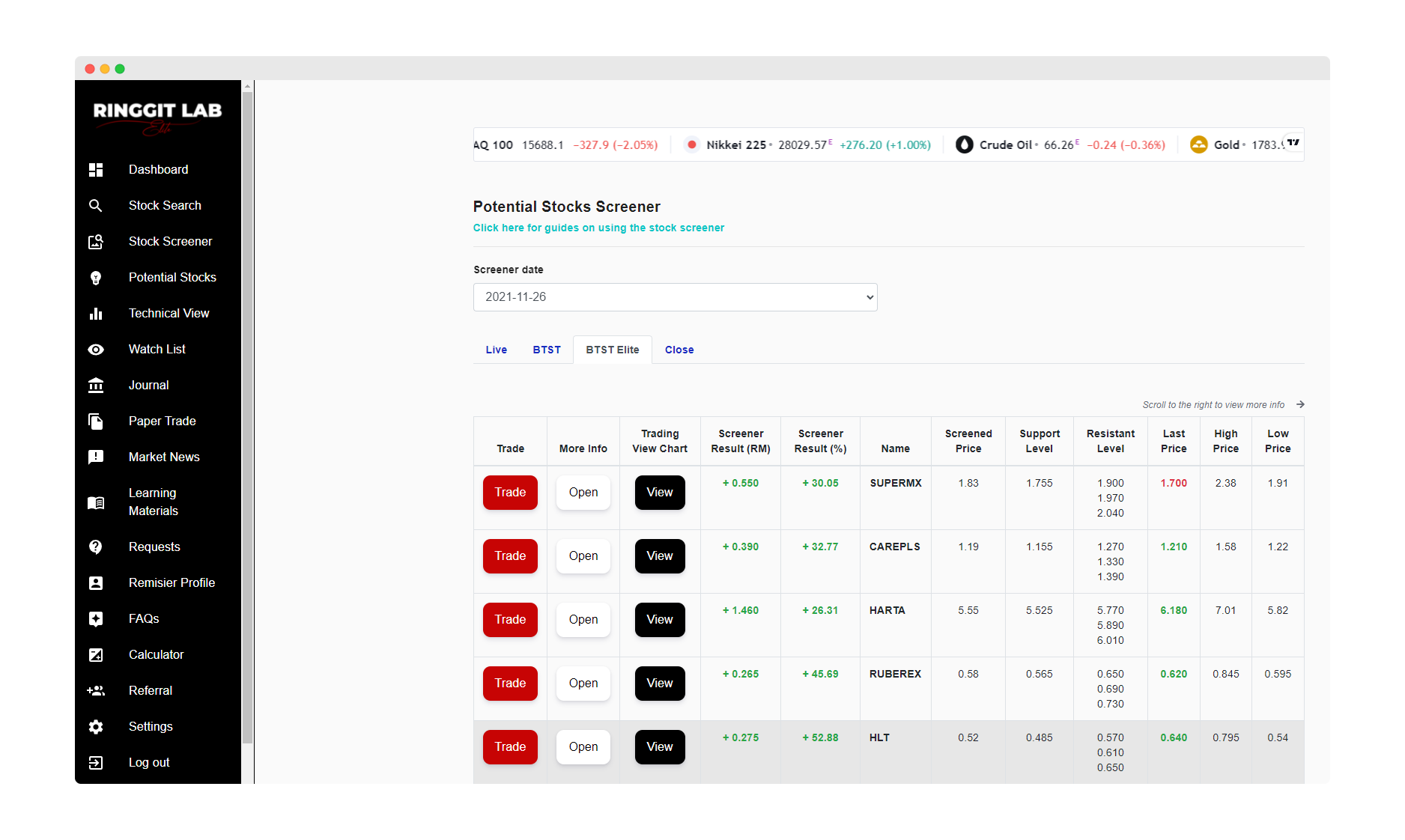

KLSE Potential Stock Screener

Our potential stock screener has more than 90% of winning-rate

How Ringgit Lab Elite Potential Stock Screener works?

1. Live tab

The list of potential stocks that might gain profits during that trading day. This screener is based on 15-minutes delayed data during the market opens.

2. BTST tab

The list of BTST potential stocks that might gain profits on the next trading day (screen after 4 pm).

3. BTST Elite tab

The list of BTST Elite potential stocks that might gain profits on the next trading day (screen after 4:30 pm).

4. Close tab

The list of potential stocks that might gain profits on the next trading day based on the trading activities on that day (screen after the market closes).

How Ringgit Lab Elite chooses the potential stocks?

Ringgit Lab Elite Potential Stock Screener is developed with guidance, assistance and insights from multiple experienced traders, the techniques that are proven to result more than 90% winning-rate.

Market maker move indicator

Prediction based on current trend

Technical & Fundamental analysis

Explanations

Market Maker Move Indicator

A market maker (or well-known as Jerung in Malaysia) is an individual market participant or member firm of an exchange that also buys and sells securities for its own account, at prices it displays in its exchange's trading system, with the primary goal of profiting on the bid-ask spread, which is the amount by which the ask price exceed the bid price a market asset.

As the name suggests, market makers "create the market". In other words, they create liquidity in the market by being readily available to buy and sell securities. This creates liquidity within the market. Without market makers, the market would be relatively illiquid and other trades would be impacted.

As a retail traders, we want to follow the steps of market makers. We want to buy securities when they buy, and sell the securities before they sell. Easy right?

Predictions based on current value

Ringgit Lab Stock Screener tries to understand where a stock's price is going based on market behavior as evidenced in its market statistics (presented in charts, price and trading volume data). It determines where the price of the stock is trending. Some of the values our screener takes are:

The ratio of buy value and sell value

Transaction volume

Buy Value / Sell Value

Traded volume

Technical & Fundamental analysis

Ringgit Lab Elite searches for good quality stocks based on both technical and fundamental analysis. Ringgit Lab Elite Potential Stock Screener screens based on:

Quarter report net profit

Earning Per Share (EPS)

Profit / Earning Ratio

Exponential Moving Average 5 days period

Exponential Moving Average 20 days period

Moving Average Convergences Divergences (MACD)